Your credit score

it is one of the most critical factors in your financial life. Your credit

score determines if you are approved for a loan or line of credit. Credit

scores are used to determine: if you will be hired for a job, interest rates,

terms and conditions, downpayment costs, rates for medical and other insurance

coverage, approval for cable and internet service and more.

A credit score is

a mathematically calculated number developed by the Fair Isaac Corporation

(FICO) that lenders use to rate potential customers in determining the

likelihood that a customer will pay their bills on time.

A credit score or

credit rating is determined by using five main criteria as defined by

MyFico.com: your payment history which accounts for 35% of your credit score,

the amounts owed which accounts for 30% of your credit score, the length of

your credit history which accounts for 15% of your credit score, new credit

which accounts for 10% of your credit score, and the types of credit used which

accounts for 10% of your credit score.

Payment history

shows the history of how you paid your bills either on time or late. Amounts

owed shows the total amount of credit you have available. The length of history

indicates how long you have had credit. New credit indicates how many times you

have applied for new credit. If you open too many new accounts in a short

period of time this may lower your credit score. The types of credit used

indicate the types of accounts you have such as revolving or installment

accounts. Revolving accounts are usually credit cards and installment accounts

are usually mortgages, auto loans, etc.

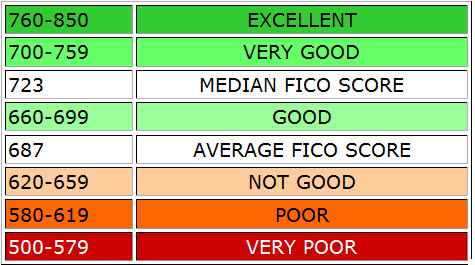

The FICO credit

score model ranges from 300-850 with 850 being an excellent score and 300 being

the worst score. The higher the credit score the lower the interest rate you

will receive for a loan or line of credit. Possessing a good credit score can

save you thousands of dollars in interest over the life of the loan or on a line

of credit. A good credit score is generally in the range of 720 or above but may

vary from lender to lender.

When applying for

credit or a loan if all three credit scores are pulled, the middle score is

generally the score used with the application.

Your credit score varies from each bureau because each agency collects

their own data from various sources and may collect different data for the same

account. Your score can vary anywhere from 5-40 points between the three credit

bureaus.

Your credit score changes due to updates to your credit file which changes based on account activity such as balance changes or additions to your credit file (i.e. new accounts or deletion of older negative accounts more than 7 or 10 years old). As a result, you may see a difference in your score from one month to the next. Here are some guidelines to help you determine how payments affect your credit score:

Payments

- Paying a 30 day late payment can increase a score by 3-80

- Paying collection accounts can increase a score by 20-90 points

- Paying public records (judgments, tax liens, Chapter 7 or Chapter 13 bankruptcy) can increase a credit score by 75-150 points

- Paying a charge-off can increase a credit score by 50-100 points

- Paying a repossession can increase a credit score by 50-100 points

- Paying delinquent student loans which can increase a credit score by 50-80 points

The major disadvantage of credit scoring is that it relies on information

in your credit report that may contain errors. It is estimated that 75% of

credit reports contain at least one error.

That is why it is so important that you check your credit report at

least once a year to ensure that all information is accurate and up to date.

If you plan on

purchasing a large item such as a car, house or investment property, it is best

to pull your credit yourself to see if any negative items appear so you can fix

those issues before applying for a loan. The best way to understand your credit

score is to do research and read the information that is included when you

order your credit report.